How has COVID-19 affected your business? If providing services for federal tax liens, you need a way to quickly and efficiently identify and purchase documents. However, finding those liens by searching countless databases and websites takes time and a little luck.

Also, you may not be able to enter the county courthouse to use their terminal or look at hard copies of records because of pandemic-related restrictions on visitors.

These and other issues are common to the trade.

Pandemic Pandemonium

Due to the COVID-19 pandemic, many public courthouses and other buildings are restricted to essential personnel or place limits on the number of visitors or amount time that can be spent inside. Asking to search county records, most of which are now digitized, will not be seen as an essential service, especially if it’s done for commercial purposes.

The county isn’t interested in filling up your quota of leads for the week and will direct you to use the county website or database, if available; to find what you need.

The IRS Is No Help

For much the same reason, the IRS office doesn’t have the time or the person-power to look up multiple federal tax liens. Aside from the fact that providing bulk lists isn’t their thing, they won’t be able to find anything without specific information from you.

It’s highly doubtful you can convince the IRS to deliver a list of federal tax liens for Collin County, Texas that were filed between January and June of 2019.

Non-Billable Hours Wasted

A paralegal can spend several hours a day searching for new liens filed in each county. Even if you are only interested in a large metroplex, that still adds up to more county websites than you have time to search.

For example, Harris County and the surrounding area have more than three million records. For 2019, Harris County recorded almost 580,000 records by itself.

Other time-wasting obstacles include:

● Nonstandard nomenclature, terminology, and labels between counties.

● Some counties don’t separate different types of liens and lump them under a single blanket document type

● Keying in dozens of search terms in multiple databases.

● Transferring information from the county documents to your office system.

You could pay someone else to do the searching and transcribing for you, but the result is the same - wasted time.

Money Wasted

Some, possibly many, of the online databases where you find public records require you to purchase a document without ever seeing the details it holds. How many liens would you need to purchase to find enough to meet your search criteria and lead quota?

You won’t be able to select only federal tax liens recorded in the past week that are over a specific number of dollars. You will need to shell out cash and only then be allowed to read what you have.

What percentage of these are quality leads? There’s no way to know ahead of time. Not only did you pay for documents you can’t use, you paid for the time needed to sift through them to find the gold.

Too Late - a Competitor Already Contacted Your Prospect

If finding one federal tax lien is difficult, finding a new one before someone else does is nearly impossible. But if you are delayed getting the information, your competitors may get there first. You all start at the same starting line, but somehow someone else found that potential client before you did.

IT Security Problems

Every day, more and more public records are infected with malicious software. If you download an infected document, you put your own systems at risk of breach or shutdown.

There doesn’t seem to be a way around these issues. And there wasn’t until now.

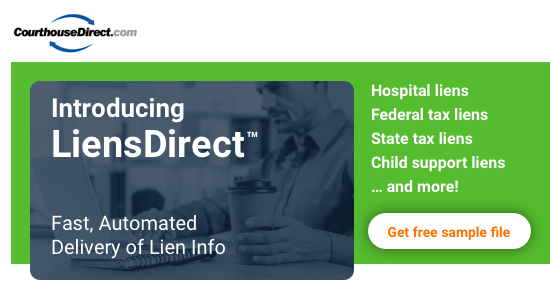

LiensDirectTM

LiensDirect is a service that identifies the federal tax liens you want without wasting time, money, or effort.

By signing up with LiensDirect, you can receive notifications and copies of newly recorded liens that are only for federal tax purposes. You can cut off anything below a certain value and narrow the search in other ways.

Visit LiensDirect to find out how it can rev up your revenue without wasting a lot of gas.