Laws governing land ownership are complex. Understanding land ownership rights and processes can help any prospective land owner avoid the risk of an improper sale, scam, or undisclosed property issue. Before you transfer property rights or possession through any contract, explore these important facts about land titles.

What Is a Land Title?

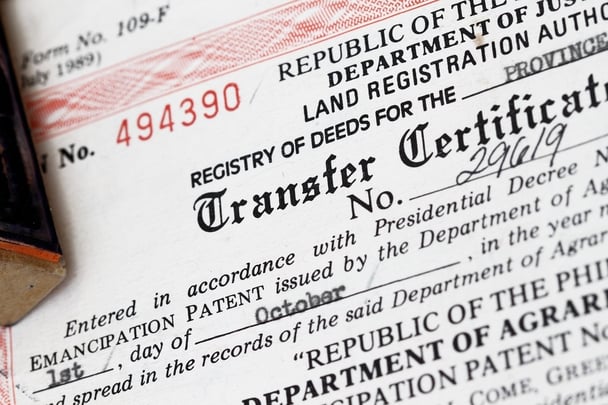

A land title or certificate of title is a formal document outlining the rights a person or people hold in a piece of property. While commonly used to confirm ownership of the property, a title can also help prospective purchasers and land owners understand more about existing liens, usage rights, easements, natural resource rights, and other rights. If a property title does not list your name, another party may legally own the property.

The clerk’s office at the county courthouse maintains all property records in a given county. The clerk’s office records all legally recognized land rights and ownership transferences. Recorded documents take precedence over informal ones in land disputes. A legally valid land title plays a crucial role in land ownership and usage agreements.

7 Facts About Land Titles You Should Know

As you explore your rights and responsibilities during land contract negotiations or disputes, consider these important aspects about land titles.

1. A title is not the same as a deed. Deeds are legal instruments used to transfer a title from one party to another. The deed outlines the terms of the transfer including the parties involved and the parcel of land. To formalize the transference of land ownership rights, the county clerk’s office must receive a legally recognized copy of the deed. With the deed on record, the certificate of title will change to reflect the change in ownership. Both the deed and the title are crucial instruments in real estate ownership matters.

2. A title proves ownership. Barring a valid legal dispute, a land title serves as an authoritative record for land ownership. Without the appropriate title, the legal system will not recognize an unfiled deed or informal contract.

3. Property owners should keep land titles in a secure location. While land owners can request a copy of the original certificate of title from the county clerk’s office for a fee, most prefer to keep their land ownership documents together in a safe place such as a safety deposit box or safe. Access to a copy of the title can facilitate land negotiations and prevent disputes.

4. All owners can hold their own duplicate titles. Each owner of a land title can hold a legally valid copy of the title. Land owners and co-owners may include those with:

- Tenancy in common. These individuals hold a certain percentage of ownership of the land.

- Community property. Married individuals often equally share property ownership as community property.

- Trust-based ownership. During estate planning, many individuals set up trusts as title owners to offset property tax liability.

- Company-based ownership. A company may legally own the title to the property instead of an individual or group of individuals.

The register of deeds will make a note of each owner’s copy in the recordkeeping system to confirm the validity of each county-issued copy. In the case of trust and company-based ownership, a recognized administrator may hold a copy of the title on the trust’s or company’s behalf.

5. Prospective land owners often conduct title searches to uncover potential issues. During a title search, an investigator will look at years’ worth of land documentation to identify potential issues with land ownership. A title search can prevent unsuspecting new owners from accepting liability for past issues. For example, a property owner cannot sell or transfer ownership rights of a property with unresolved tax issues. An outstanding lien can render any ownership transaction invalid.

Title searches reveal information about property taxes, property work agreements, CC&Rs (covenants, conditions, and restrictions), issues with deed documentation and unresolved ownership claims, and more. If a past property owner gave a company or person easement or property usage rights, the search will also reveal these recorded covenants.

While buyers and lenders commonly use title searches during the buying/selling process, many other parties may benefit from a title search. Home builders, businesses, and government officials may all use title searches for risk management and investment protection purposes.

6. Title insurance offsets the risk associated with title transference. To minimize the effects of issues not discovered during a title search, many land buyers invest in title insurance as part of the closing costs of a transaction.

Owner’s title insurance often provides coverage for losses up to the full price of the title in the event that an issued jeopardizes a claim to ownership in the future. Owner’s insurance policies will also cover dispute resolution legal costs including damages awarded to another party up to policy limits. Lender’s title insurance protects the lender’s agreement with the borrower. In the event of a land dispute, the policy will cover the lender’s losses and legal expenses.

7. Land title governance varies, sometimes widely. In the United States, individual states handle estate and real property governance. Countries such as Australia use a guaranteed title governance system called a Torrens title system. Under the Torrens system, those listed in the county title records retain undisputable ownership of the land in question.

Some states in the US have incorporated aspects of the Torrens system into their title governance systems, but the system remains debated among members of the legal and real estate communities. Instead, the majority of US states use common law title governance to determine rights and ownership.

Common Torrens system titles include the Torrens title, Strata title, Company title, and Leasehold title. Torrens titles are for traditional single owner property/home ownership. Strata titles govern unit investments in multi-unit complexes (condos, villas, townhomes, etc.). Company titles allow property owners to hold shares in the company that retains ownership of the building, not the property itself. Leasehold titles give owners temporary ownership rights for government-owned land.

To find out basic information about a title, land ownership, and recorded covenants, individuals can go directly to the courthouse, use an online database, or work with an attorney or real estate professional to conduct property due diligence. Land titles play an important role in protecting ownership rights and avoiding risks associated with real estate transactions. Keep this information in mind the next time you think about purchasing property or entering into any property-related contract with a land owner.