What Does your Mortgage Payment Really Include?

- CourthouseDirect.com Team

- 10/03/2018

- Real Estate

Have you ever stopped to look at your mortgage statement? You may notice there are several different numbers aside from the total you pay each month. While paying a single monthly amount seems reasonable, you would be better served by ...

READ MORE

How Long are Property Appraisals Valid?

- CourthouseDirect.com Team

- 06/20/2018

- Mortgage

Property appraisals may not have expiration dates, but, typically, lenders tend to reject appraisals that are more than 120 days old. In other cases, the expiration date may be within 60 to 90 days. Some lenders will allow up to 180 days ...

READ MORE

The Ultimate Mortgage Application Checklist

- CourthouseDirect.com Team

- 05/09/2018

- Mortgage

Buying a home is a significant moment in anyone’s life. For most people, it is a financially straining purchase. Most people need to apply for a mortgage loan. Follow these steps to successfully apply for a mortgage loan for your home.

READ MORE

The Most Common Types of Mortgages

- CourthouseDirect.com Team

- 11/01/2017

- Mortgage

Most people do not have the means to purchase a home outright in one lump sum. Instead, financing options allow homebuyers to pay for a house in increments over time. If you want to buy a home but need financing for this major investment, ...

READ MORE

The Most Common Issues Mortgage Underwriters Face

- CourthouseDirect.com Team

- 10/25/2017

- Mortgage

Lenders will never approve a mortgage without first conducting their own due diligence in the form of underwriting. A mortgage underwriter reviews, confirms, and analyzes loan applications to minimize the risk associated with the loan. ...

READ MORE

Mortgage vs. Home Equity Loan: Understanding the Differences

- CourthouseDirect.com Team

- 09/27/2017

- Mortgage

Home ownership opens the doors to two different types of loans that non-home owners cannot access – mortgage loans and home equity loans. While these two loan agreements feature many similarities, they are very different. Home owners must ...

READ MORE

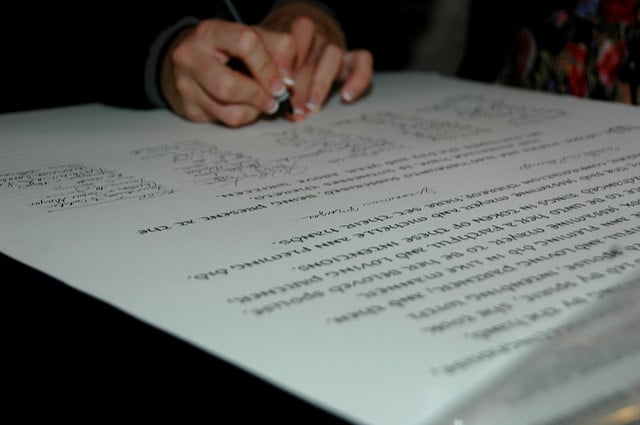

How Does a Quitclaim Deed Affect Your Mortgage?

- CourthouseDirect.com Team

- 08/23/2017

- Real Estate

A quitclaim deed is a document that transfers legal ownership and interest of a property from one person (the grantor) to another (the grantee). Unlike a warranty deed, a quitclaim deed does not offer assurances that the land in question ...

READ MORE

Can Mortgage Record Errors Be Fixed?

- CourthouseDirect.com Team

- 01/20/2016

- Mortgage

Ideally, lenders will double and triple check everything before filing a formal mortgage record. Unfortunately, mistakes do happen, and an error on your mortgage record can hinder property transfer, bankruptcy proceedings, and the ...

READ MORE

Mortgage Records 101: Finding and Understanding Mortgage Records

- CourthouseDirect.com Team

- 12/16/2015

- Mortgage

If you handle real estate transactions as part of your business, you have to do lots of research. Real estate is one of the biggest investments most people make, so it’s important that you help your clients prepare properly for this ...

READ MORE

Preparing to Refinance Your Home: What You Need to Know

- CourthouseDirect.com Team

- 02/21/2014

- Real Estate

Every year, hundreds of thousands of homeowners prepare to refinance their mortgages. In recent years, favorable financial conditions have led to an upsurge in this trend. While it's always advisable for homeowners to speak with financial ...

READ MORE

Subscribe to our updates

About CourthouseDirect.com

CourthouseDirect.com is committed to providing fast, accurate and affordable courthouse documents and research by using the potential of the Internet to cut costs and save time associated with obtaining public records and thereby eliminating inefficiencies and revolutionizing the delivery of courthouse information nationwide.